WHSI is my Breakout Alert with 2 Major Catalysts and a 100% Buy Rating at BarChart.com

I am issuing an immediate alert on Wearable Health Solutions, Inc., WHSI.

Barchart.com rates WHSI a “100%” Buy!

Short, Mid, and Long Term indicators are bullish.

The company’s latest press could be a boost to the stocks’ already explosive potential.

Wearable Health Solutions Inc. (OTCMKTS: WHSI) filed an 8K with the SEC on Tuesday. The filing contained multiple catalysts that could positively influence WHSI’s share valuation in the near and long term.

1. UPLISTING

WHSI has filed its Form 10-12G/A as a requirement in its stated goal of uplisting to a higher exchange. The company has now completed its audited financial statements for the previous two-year period.

Wearable Health is now in the process of and is now preparing its application to uplist.

Uplisting could be a major catalyst for WHSI’s share price.

When a company uplists it provides investors the peace of mind that comes with increased regulation, transparency and disclosure. This can translate to:

- Lower Cost of Capital–that can in turn accelerate the company’s growth and increase margins.

- Analyst Coverage– uplisting allows analysts to cover the stock and this is important because analyst coverage can lead to:

- Institutional Investment

- High-Net-Worth Individual Investors

- Increased Liquidity and Valuation- all of the above factors can lead to increased interest in the stock on all levels, and this influx of interest can be a force multiplier.

2. WEBSITES

WHSI also reported it has updated and launched several websites. These websites each serve different functions:

- Corporate (wearablehealthsolutions.com)

- Product (ihelpalarm.com)

- DTC ‘Direct-to-Consumer’ (1800medalert.com)

- Investor Relations (wearablehealthsolutions.com/investor-relations)

The newly updated websites bring more to the table than might meet the eye at first glance. In addition to looking professional and more polished than previous iterations; investors, buyers, and dealers will find them more robust. Investors familiar with WHSI may be able to infer the next logical conclusion…the iHelp Max 4G launch.

The launch of WHSI’s device would be another catalyst for share valuation.

For the fiscal year ending June 30th, 2021, WHSI reported some 8,000 end users plus an order book of about 2,000+ potential activations, which earned the company record revenues ($1.3 million) in 2021.

Launching this new device could lead to a consecutive year of record sales.The company has already launched a major marketing campaign on ‘Worldwide Business With kathy ireland®” show which reaches over 200+ Million households broadcast on FOX Business Network, Bloomberg International Television and video streams on all major social media platforms.

Wearable Health Solutions, Inc. (WHSI) is a medical device company that touches several lucrative healthcare segments with its suite of products. The company has experienced tremendous growth recently, and there is reason to believe this will continue or maybe even accelerate.

WHSI Set to Soar

Wearable Health Solutions, Inc. (OTCMKTS: WHSI) is a manufacturer of next-generation, advanced technology personal medical alarms and safety alert devices. WHSI’s technology can provide a leading edge for the Company in our current cutting-edge technology-driven markets.

- Unique Opportunity

Only Publicly Traded Small Cap Stock in the $7.4 Billion PERS Market–19-24% addressable market by 2030

- Major Marketing Campaign Kickoff Imminent

WHSI is launching a worldwide marketing campaign to expand its international network of distributors. Production is underway for the company’s spots on the weekly ‘Worldwide Business With kathy ireland®” show. Ireland’s Company Reaches Over 200+ Million Households broadcast on FOX Business Network, Bloomberg International Television and video streams on all major social media platforms.

- iHelp Max 4G Release

WHSI’s iHelp MAX™ 4G device is reportedly launching this year. The device will do more than transmit an emergency alarm for the user. It will also send medical personnel vital signs, such as heart rate. This next-generation release would be huge for WHSI stock.

- WHSI Up Listing

WHSI’s Mark Cayle recently commented after releasing its Form 10, “Once our Form 10 Registration Statement is effective, we will consider an up listing to a broader stock exchange which could expand our exposure to institutional investors, money managers, family office funds, broker dealers, and other investors which is an important milestone in our corporate progression,” he concluded. An uplisting would be a major catalytic event.

WHSI’s Market

Currently, WHSI competes in:

- The $23.3 billion remote patient operating market (RPM). Research firm MarketsAndMarkets projects this market will grow at a CAGR of 38.2% to reach $117 billion by 2025..

- The giant mobile health (mHealth) market which is forecast to reach $166.2 billion by 2028, according to GrandViewResearch.

- And the $4 billion personal emergency response market. MarketDataForecast forecasts that the (PERS) market will grow from $4.09 billion in 2021 to $5.29 billion globally by the end of 2026. That represents CAGR growth of 5.3%.

- The Lone Worker Market, is WHSI’s latest market entry, Estimated at over 200M globally, 56M in North America, South America, and Europe, lone workers are a huge opportunity. It is a growing insurance risk with over 36,000 work-related fatalities per year, 26M – 45M non-fatal incidents per year resulting in at least 4 days of work lost, and an estimated 4-6% impact on total labor costs

WHSI Revenues

WHSI is a multiple revenue stream company. WHSI forecasts that its sales could reach $5.87 million in 2022. In the nine-month period ended March 31, 2021, total revenues were $1.03 million. It represents a 37% jump from $757,000 for the comparable period in 2020. For the first nine months of this fiscal year, WHSI reported $488,000 in gross profit or 47.1% of total revenues. That is very impressive for a stock trading where WHSI is currently.

WHSI’s Advantage

WHSI appears to be the only small-cap publicly traded pure-play in the PERS industry. Most of WHSI’s competition sells directly to end-users, but WHSI’s business plan is different in that they primarily are selling to dealers, which not only creates recurring revenue but also calls for substantially less customer service calls/overhead.

Continue Reading for a more in-depth look at Wearable Health Solutions, Inc. (WHSI) and why it should be on your watchlist today:

OVERVIEW

Wearable Health Solutions, Inc. (the “Company” or “WHSI”), is a personal monitoring technology developer focused on mobile alert and tracking devices for emergency medical and occupational safety markets worldwide, concentrating on North American markets.

REVENUE MODEL

WHSI generates revenues primarily from:

- PERS device sales

- Recurring service fees from monitoring subscription plans

WHSI primarily does business in the US and Canada, however, it is an international company and has made sales in countries such as New Zealand, Denmark, Ireland, Brazil, Barbados, Bermuda and the People’s Republic of China.

WHSI’s COMPETITIVE ADVANTAGE

Unlike the majority of existing PERS companies, the Company’s products are distributed predominantly on a wholesale basis to dealers consisting mainly of residential security companies, home healthcare providers and rehabilitation centers, and to retail customers through mass outlet chains or direct in-house sales channels. This helps WHSI save on overhead related to customer service.

Working with more than 15 central monitoring stations and approximately 200 dealers, WHSI reported serving over 7,000 end-users as of November 2020 and filling an order book of 2,000+ potential activations.

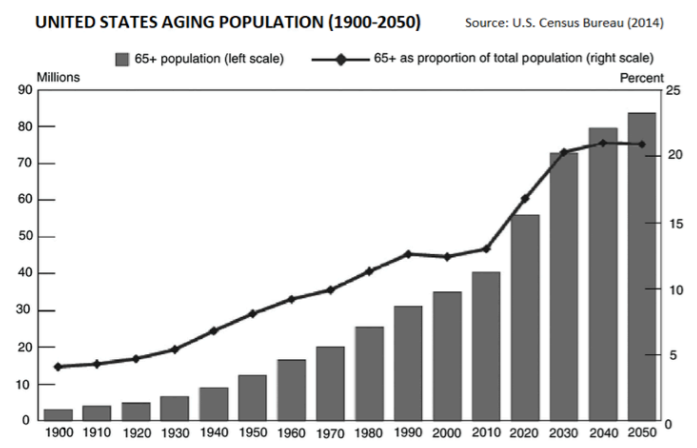

Fueled by rapidly-growing worldwide geriatric populations (see chart below), especially in developed countries targeted by WHSI, and technology-driven mobile healthcare (“mHealth”) trends invigorated globally by the COVID-19 pandemic, the already-vibrant PERS industry was estimated by ReportLinker.com to post a 14.8% revenue growth spike in 2020, benefitting long-term from the converging telemedicine practices and Internet-of-Things (“IoT”) communication technologies.

Unlike the majority of existing PERS companies, the Company’s products are distributed predominantly on a wholesale basis to dealers consisting mainly of residential security companies, home healthcare providers and rehabilitation centers, and to retail customers through mass outlet chains or direct in-house sales channels. This helps WHSI save on overhead related to customer service.

Working with more than 15 central monitoring stations and approximately 200 dealers, WHSI reported serving over 7,000 end-users as of November 2020 and filling an order book of 2,000+ potential activations.

Fueled by rapidly-growing worldwide geriatric populations (see chart below), especially in developed countries targeted by WHSI, and technology-driven mobile healthcare (“mHealth”) trends invigorated globally by the COVID-19 pandemic, the already-vibrant PERS industry was estimated by ReportLinker.com to post a 14.8% revenue growth spike in 2020, benefitting long-term from the converging telemedicine practices and Internet-of-Things (“IoT”) communication technologies. WHSI PRODUCTS

MediPendant®

WHSI’s MediPendant® is a second-generation wearable product. It is a personal alarm device. Technology sets it apart from a majority of its competitors. It is water-resistant so it can be used in the shower, where most falls occur. The user can also communicate with an operator through the pendant itself through a two-way speakerphone.

iHelp™

iHelp™ remote medical alert system is a fully mobile PERS solution that operates anywhere with cellular coverage. It is upgraded as next generation bandwidths are introduced in telecommunications. iHelp+™3G is WHSI’s most advanced mobile PERS-compliant product. It offers tracking, geo-fencing, fall detection and extended battery life. It also has voice prompts for safety risk.

iHelp MAX™ 4G

iHelp MAX™ 4G is currently in the testing and production phase as the telecommunications industry converts to faster 4G. It features Wi-Fi, NFC (wireless data transfer) technology and Bluetooth 4.0 Low Energy features. It also offers “telehealth-ready” advantages such as remote monitoring and transmission of the user’s health vitals to emergency personnel and caregivers.

iHelp Lone Worker

iHelp Lone Worker is a customized safety program targeted especially for the 200 million isolated or lone workers globally. It provides them a way to communicate should their health or safety be threatened. It is a wearable system that operates indoors or out. With over 36,000 work-related fatalities per year, 26M – 45M non-fatal incidents per year resulting in at least 4 days work lost, and an estimated 4-6% impact on total labor costs; this is a major opportunity for WHSI.

WHSI’s COMPETITION

The PERS market is fragmented and highly competitive, with numerous providers leading the industry since the period of first generation products, as well as subsequent successful market entrants focused solely on mPERS solutions. The largest players in terms of disclosed subscription levels are:

- Philips Lifeline, a division of Koninklijke Philips NV (NYSE: PHG), a Dutch multinational electronics manufacturer, with over 750,000 active users, formed in 2006 following a $750 million purchase of Lifeline Systems, Inc., an industry pioneering company established in 1974, which at the time of acquisition had approximately $150 million in annual revenues and a predominantly North American subscriber base of nearly 470,000 seniors;

- GreatCall, founded in 2005, which was acquired with more than 900,000 subscribers by Best Buy Co., Inc. (NYSE: BBY) in 2018 forConnect America, operating since 1977, which acquired Tunstall Americas, a division of Tunstall Healthcare Group Limited in 2019, bringing the number of active users to more than 300,000.

- Other companies with well-established operating histories and market positions, but undisclosed subscriberships include independent private providers, such as Life Alert Emergency Response, VRI, Healthcom, LifeFone, LifeStation, Numera, ADT (NYSE:ADT), Medical Guardian, Bay Alarm Medical, LogicMark and MobileHelp.

Competing directly with all aforementioned, WHSI appears to be the only small-cap publicly traded pure-play in the PERS industry. Many of the above-mentioned companies sell directly to end-users, but Wearable Healths Solution’s business plan is different in that they primarily are selling to dealers, which not only creates recurring revenue, but also calls for substantially less customer service calls/overhead.

Strategic Technology Acquisitions And Agreements

- The Company has engaged R&D firm MIDI Product Development Corporation (MIDI), an expert in medical innovation. MIDI is to develop and commercialize for WHSI a biometric sensor to communicate with the company’s flagship product 4G iHelp MAX™ product platform. It is titled the iHelp Next Generation Platform (NGP). WHSI-MIDI’s collaboration goal is to add to the platform’s existing safety monitoring capability. Health monitoring and medication reminders will be added. This next generation platform would monitor in real time medical vitals, such as blood pressure and oxygen levels. Seamless integration is the desired result.

- WHSI acquired the assets and technology of mHealthCentral Cloud Management and Automation platform. The Baas technology dealer portal would be used in WHSI’s next generation iHelp™ MAX cellular and telehealth-ready mobile medical device. The acquisition will deploy and integrate advanced technology such as IoT into the medical devices markets. The platform is a cloud-based service for accepting data transmission from personal safety and medical devices. To the front end portal/user, this will be designed as a user-friendly monitoring platform.

- WHSI signed a licensing agreement with Speak to IoT to bring its patent-pending voice technology enabling Voice AI control into all of the company’s existing Smart devices with IoT.

FINANCIAL GOALS

WHSI forecasts that its sales could reach $5.87 million in 2022. In the nine month period ended March 31, 2021, total revenues were $1.03 million. It represents a 37% jump from $757,000 for the comparable period in 2020. For the first nine months of this fiscal year, WHSI reported $488,000 in gross profit, or 47.1% of total revenues.

The net loss for the first nine months ended March 31, 2021 was $1.27 million vs. $364,000 for the same period the prior year.

For its last full fiscal year, the 12 months ended June 30, 2020, WHSI reported sales of $1.16 million. Gross profit was $693,021, or a 59.6% margin rate. It reduced its net loss that year to $454,639 vs. $715,462 the prior year.The Globe Small Cap Research LLC report in October 2021 believes that tech forward devices coming in 2022 “could support the Company’s guidance for an increase in full year revenues.” It is named the iHelp MAX™ 4G, due in 2022. Globe also said Company plans for integration of voice AI technology into its Smart devices will differentiate WHSI products from competitors.

EXPERIENCED MANAGEMENT

The Company’s seasoned management team has over 30 years of combined PERS industry experience and a track record in executive management of publicly traded microcap companies.

The Company’s seasoned management team has over 30 years of combined PERS industry experience and a track record in executive management of publicly traded microcap companies.

Harrysen Mittler, CEO and Chairman, has over 30 years of experience in corporate finance, mergers and acquisitions, business administration and commerce. Prior to joining the Company in December 2019, Mr. Mittler served as Chairman, CEO and CFO of Pacific Software Inc. (OTC: PFSF), an enterprise software development and acquisition company for emerging technologies, since 2016. Previously, he served as Director and CFO of Nortia Capital Partners Inc., a then publicly traded merchant banking company, Chairman and CEO for Grand Prix Sports Inc., an international motor sports racing team, as well as for Autoworks International Ltd., a company then quoted on the Frankfurt Stock Exchange. At the beginning of his career, Mr. Mittler has also served in the audit division of Deloitte Haskins and Sells, the predecessor to Deloitte & Touche LLP.

Harrysen Mittler, CEO and Chairman, has over 30 years of experience in corporate finance, mergers and acquisitions, business administration and commerce. Prior to joining the Company in December 2019, Mr. Mittler served as Chairman, CEO and CFO of Pacific Software Inc. (OTC: PFSF), an enterprise software development and acquisition company for emerging technologies, since 2016. Previously, he served as Director and CFO of Nortia Capital Partners Inc., a then publicly traded merchant banking company, Chairman and CEO for Grand Prix Sports Inc., an international motor sports racing team, as well as for Autoworks International Ltd., a company then quoted on the Frankfurt Stock Exchange. At the beginning of his career, Mr. Mittler has also served in the audit division of Deloitte Haskins and Sells, the predecessor to Deloitte & Touche LLP.

Peter Pizzino, President and Director, had a 25-year career in the securities and investment industry when joining the Company in December 2019. Since 2018, Mr. Pizzino served as President of Pacific Software Inc. (OTC: PFSF), where he focused on development of BOAPIN.com. Prior to that, since 2015, Mr. Pizzino held positions in Capital Markets at Spartan Capital, then with J. Streicher Capital on the NYSE floor, where he financed public and private companies generating several hundred million dollars in client offerings. In the past, Mr. Pizzino acquired extensive international business and non-profit experience, including guiding business development and financing of emerging companies based in China. Mr. Pizzino received a B.S. degree in accounting and finance, and held several securities licenses.

Ronald Adams, EVP, has over 40 years of experience in wholesale, retail, and distribution organizations, as well as starting growing profitable companies, including founding Medical Alarm Concepts, beginning in 2008. Before that, he served as President of Connective Home, an installer of low voltage wiring for Smart Homes from 2001-2008. Previous to this, he served as the President and CFO of a NASDAQ company, which he started and later sold. Mr. Adams graduated from the U.S. Merchant Marine Academy at Kings Point with a B.S. in Engineering and as a Lieutenant JG in the U.S. Navy. In 1996, Mr. Adams received the prestigious Entrepreneur of the Year Award, sponsored by Dow Jones, NASDAQ, and Ernst & Young.

Jennifer Loria, COO, has over 20 years of experience developing and executing strategic business plans, establishing and streamlining internal operations, and developing growth strategies for startup companies. Having joined the Company in December 2008 as VP of Marketing for Medical Alarm Concepts LLC, Ms. Loria was responsible for brand development and execution of go-to-market strategies. Prior to joining the Company, Ms. Loria worked at Buck, a global HR benefits and human resource consulting firm controlled by H.I.G. Capital. Ms. Loria holds a master’s degree in journalism and a bachelor’s degree in business administration.

Gail Rosenthal, CFO, has over twenty years of experience in corporate finance, mergers and acquisitions, accounting and auditing. Prior to joining the Company in September 2020, Ms. Rosenthal has served as senior audit manager for a boutique auditing firm until 2010, and has subsequently concentrated on private consulting work. Her experience spans manufacturing, distribution and retail, film production, banking and finance, IT and software development, and she is an expert in communications and leadership. Ms. Rosenthal is a graduate of University of California San Diego in La Jolla, CA.

DUE DILIGENCE LINKS:

Website: https://www.wearablehealthsolutions.com/

News

Wearable Health Solutions Inc. (WHSI) Files Form 10 Registration Statement With SEC

Castle Placement Named Exclusive Placement Agent for Wearable Health Solutions Inc.

Top Ranking Independent Research Firm Features Wearable Health Solutions, Inc. in Detailed Report

Wearable Health Solutions Inc. in development of a new 4G “Telehealth Ready” product

Research Report

http://wallstreetresearch.org/reports/WHSI-Profile.pdf

Product Brochures

Lone Worker Program

iHelp Dealer Program

http://www.wearablehealthsolutions.com/wp-content/uploads/2016/06/iHelp-Complete-Dealer-Program.pdf

This article is part of a sponsored investor education program. WSGV has been compensated by WHSI for this advertisement. WSGV is not a registered financial advisor. Do your own due diligence before making any investment decision.